RECENTLY FUNDED TRANSACTION PORTFOLIO

July, 2025

Bridge Loan – US Foods Chef Store

US Foods Chef Store –

$3,000,000 Loan Amount

July, 2025

Bridge Loan – East Judkins

The East Judkins Bridge Loan

$3,000,000 Loan Amount @

Prime plus 0.5%

July, 2025

Construction Loan – Hiawatha 6 plex

The Hiawatha project is a 6 unit SFR that is being held as a long term investment

$3,400,000 at Prime Plus 1%

August, 2024

Recapitalization Bridge Loan

Recapitalization Bridge Lending Terms:

18 Month Financing

$1,900,000 Loan Amount

$4,620,000 Appraised Valuation

August, 2024

Apartment Rehab Transaction

Apartment Rehab Loan Terms:

12 Month Financing

$700k Rehab Costs

$4,100,000 Appraised Valuation

August, 2024

Automotive Acquisition

Automotive Acquisition Financing Terms:

$750,000 Loan Amount

w/ $100,000 Business Line of Credit

Two contingous SFR properties located on the desireable Capitol Hill neighborhood of Seattle on Broadway Ave E being held for future development.

$1,700,000 Loan Amount

April, 2022

Stanley Condominium Construction Loan

Currently under construction, Stanley contains 19 new modern style condominiums in the thriving Georgetown district of Seattle.

$6.300,000 Loan Amount

6.0% Interest Rate

65% of Total Project Costs

IO Interest Reserves

February, 2022

Shoreline “Scout” 16 Unit Modern Townhouse project

Another successful construction project with our long lasting relationship with Storybuilt. 16 units of modern townhouses.

$8,600,000 Loan Amount

5.5% Interest Rate

75% of Total Project Costs

IO Interest Reserves

December, 2021

Bridge Loan

This 2 parcel assemblage in Clyde Hill was originally purchased by Bylington Development for $7,500,000 via a private loan. Axis RE Capital helped provide conventional financing at 75% of the acquisition price, broken into two loans against separate parcels

$5,625,000 Combined Loan Amounts

24 Month Term

Interest Only Payments

November, 2021

Clyde Hill Construction Loan

Currently under construction is a high end Single Family Residence valued over 12 million

$3,400,000 Builder’s Line of Credit

5.0% Interest Rate

75% of Total Project Costs

November, 2020

La Huerta International Market #2

Axis RE Capital helped the owner of La Huerta International market expand it’s business to own the asset they were leasing, which included a long term anchor tenant, O’Reily Auto Parts

$3,620,000 purchase price

25 year amortization

10 year term

4.25% Interest rate

November, 2020

Capitol Hill Bridge Loan for Future Apartment Complex

Congratulations are in order to the 421 Belmont LLC on the funding of their short term bridge loan while they go through the permit process to build a new 8 story apartment with approximately 89 units.

$3,290,000 Valuation

2 Year Term

Prime + 2%

65% Loan to Acquisition Price

October, 2020

Ballard Bridge Loan for Future Apartment Complex

Axis RE Capital represented 3620 Phinney LLC on the funding of their short term bridge loan while they go through the permit process to build a new SEDU apartment complex containing approximately 70 units

$3,100,000 Valuation

2 Year Term

Prime + 2%

65% Loan to Acquisition Price

September, 2020

Lake City Bridge Loan for Future Apartment Complex

Barcelo Homes Inc. on the funding of their short term bridge loan while they go through the permit process to build a new 6 story, 124 unit apartment complex with offices located at 14038 and 14040 Lake City Way NE in Seattle.

$1,280,000 Valuation

$7,125,000 MUP Valuation

1 Year Term

Prime + 2.0%

65% Loan to “As Is” Basis

August, 2020

The Buck & Bear

Axis RE Capital represented the The Wildlife Blocks on the asset repositioning of The Buck and Bear properties.

$20,800,000 Valuation

Max Loan Amount based upon a 1.25 DSCR

7 Year Fixed SWAP Option

Cash Back for Future Investments

June, 2020

Portage Bay Spec House Construction Loan

Axis RE Capital represented Barcelo Homes on a new Spec Project in Portage Bay that sits on a parcel that is roughly 6146 sq ft with over roughly 3000 sq ft of livable space with sweeping views over Portage Bay.

$2,500,000 Valuation

18 Month Term with IO Reserves

75% of Total Project Cost

Prime + 1.5%

August, 2019

Rainier Retail Center

Axis RE Capital worked with the owners to remove Seller Financing and provide a banking relationship

1.25 DSCR

5 Year Fixed / 10 Year Term

4.0% on a 25 year amortization

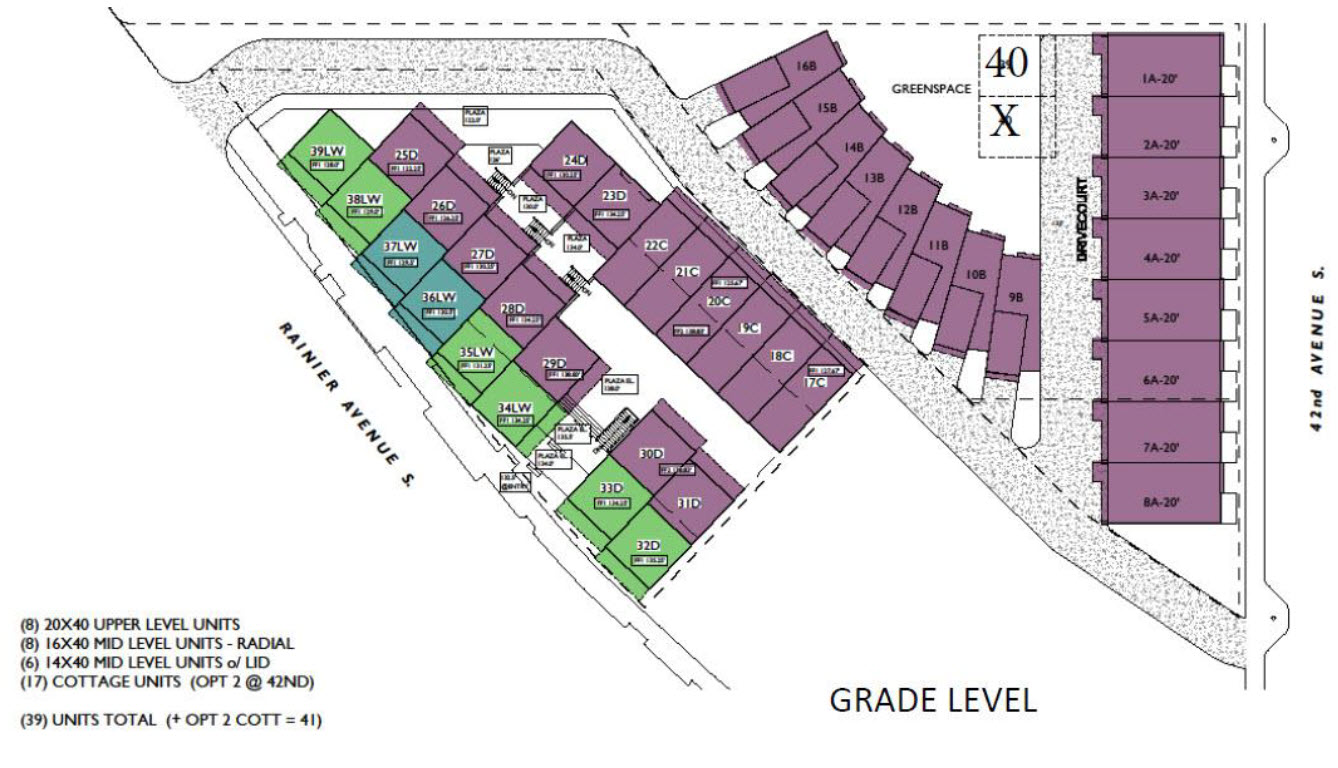

Short Term Recapitalization Loan while the Developer goes through the permit process.

$8,500,000 Loan Amount

55% of Property Valuation

March, 2019

Greenwood Retail Investment Property

$3,500,000 Purchase Price

4.875%

7/1 ARM

10 Year Term

75% Loan to Value

November, 2018

DEP Homes – 5 Units Construction

Beautiful 5 Unit Townhouse Project in Central District with DEP Homes

$1.8 Million Construction Loan

75% Loan to Cost

65% Loan To Value

12 Month IO

November, 2018

Ravenna Townhouse Project

PSW’s Revenna Townhouse Project connected with Axis Re Capital for a $8.4 million Construction Loan

Funding date should be Jan 2019

16 units of townhouses

Prime + 1.25%

75% Loan to Cost

65% Loan to Value

November, 2018

Northline Townhouse Project

Axis RE Capital represented thePSW Rea Estate on their Northline Townhouse Project, which is currently under construction for 38 new modern townhouses

$10.4 Million Loan Amount

75% Loan to Cost

Prime +1.5%

24 Month Period

Interest Only Payments

4.875%

5 Year Fixed, 10 Year Term

25 Year Amortization

75% Loan to Value

February, 2018

Leary Land Acquisition

Quick close land acquisition in the heart of thriving Ballard

$2,300,000

September, 2017

RockMeadow Equestrian Center Refinance with Cash Out

Refinance with Cash Out for property improvements

$1,650,000

July, 2017

The Gilman Station

Issaquah Retail Center in need of completion of environmental remediation

$3,650,000

February, 2017

North Seattle Retail Commercial Acquisition & Rehab

Acquisition with funds for property improvements and new commercial investor

$2,800,000

25 year amortization

7 year fixed

December, 2016

Weller Street 3 Unit Construction

James Tjoa and Associates built and sold these 3 gorgeous units

$1,300,000

12 Month IO

November, 2016

Franklin Ave Apartments

Commercial acquisition small apartment complex investor deal in Eastlake area

$1,620,000

1.15 DSCR

30 Year Amortization

10 Year Fixed

November, 2016

Better Living Adult Family Home

5.125%

25 Year Amortization

5 Year Fixed, 10 Year Term

September, 2016

Weller Street Apartments

New Apartments Construction & Rehab of an existing 5 plex

$3,600,000

12 Months IO

July, 2016

Family First Adult Family Homes

Refinance to commercial stabilization with construction loan for small apartment complex in the Eastlake area

$3,750,000

Refinance of a thriving self storage facility at lower interest rate and longer fixed term

$3,850,000

Beautiful spec project on the last lot on Bitter Lake for a first time developer

$950,000 Valuation

June, 2016

La Huerta International Market

Lease vs own small business owner scenario. Axis assisted as the RE agent and provided financing up to 80% Loan to Value

$1,650,000 Purchase Price

March, 2016

Columbia City 7 Parcel Assemblage

PSW Real Estate is planing future site of 140+ units mixed use project

$4,000,000

60% Loan To Value

Prime +2% with IO Payments

36 Month Term

February, 2016

Aurora 16 Unit Apartment

Investor acquisition for property improvement

$1,200,000

1.15 DSCR

80% Loan to Value

30 Year amortization

February, 2016

U District Dental Office Partner Buy Out / Acquisition

Partner buyout in well established dental office in the University District

$1,500,000 Valuation

May, 2015

Twin Creek Mobile Home Park

Refinance on one of the finest mobile home parks in Bothell

$2,800,000

November, 2014

Little Explorers Refinance

Helping a small business owner refinance out of a seller financed acquisition with cash out

$975,000

Up to 80% of appraised value

10 Year Fixed Term

25 Year Amortization

Fast close used to acquire a restaurant in Belltown

$350,000

November, 2012

North Beach Apartments Acquisition & Rehab

Value added apartment acquisition and rehab for 9 unit apartment complex

$1,850,000

Funded off of future stabilized value

30 year amortization

12 month IO during Rehab

5/5 Term

November, 2009

Renew Physical Acquisition & Rehab

Small business owner that acquired a property instead of leasing

$2,300,000

May of 2016

Acquisition and 12 month Rehab

IO Reserve during construction

November, 2004

Fremont 3 Parcel Assemblage

Land acquisition for future mid-sized apartment complex in the Fremont area

$2,600,000